The Facts About Paypal Business Loan Revealed

Wiki Article

What Does Paypal Business Loan Do?

Table of ContentsSome Ideas on Paypal Business Loan You Should KnowHow Paypal Business Loan can Save You Time, Stress, and Money.Facts About Paypal Business Loan RevealedThe Only Guide for Paypal Business Loan

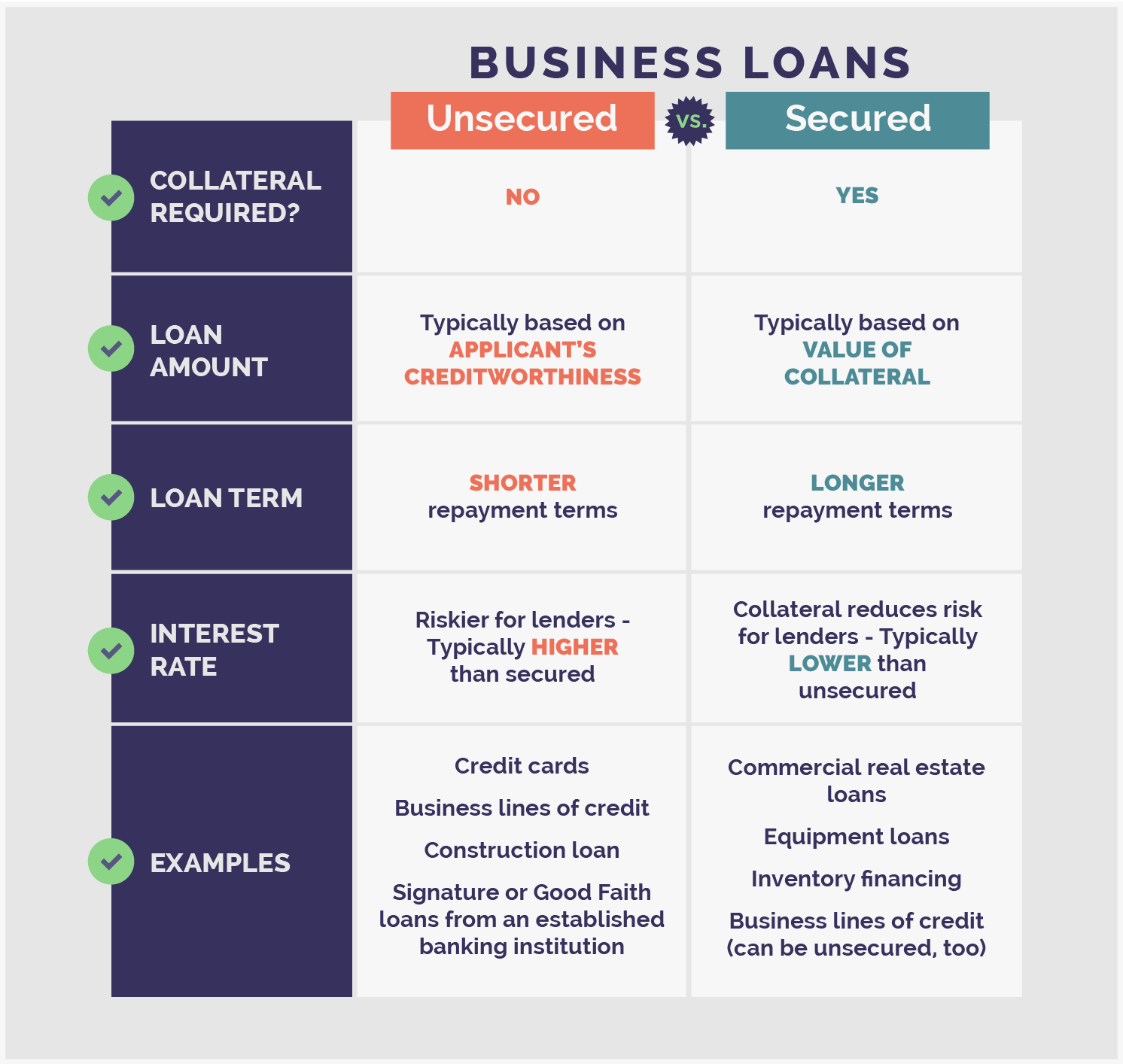

The SBA serves as the guarantor between the consumer as well as the loan provider (PayPal Business Loan). In return, loan providers present their terms and conditions, rate of interest caps as well as various other criteria which need authorization from the SBA.The SBA supplies different plans and you can pick any type of strategy which could suit your company requirementfor example, acquiring stock, paying financial obligations or home mortgages, broadening your business, and even for acquiring property.SBA financings do need a comprehensive application procedure, an individual credit report check, as well as security needs, so they aren't right for everybody. When you listen to the word "funding," a term finance from a significant financial institution is probably one of the initial things that comes to mind. A term lending is specified as a round figure, paid to a borrower with an arrangement to settle it over a collection period of time, with passion - PayPal Business Loan.

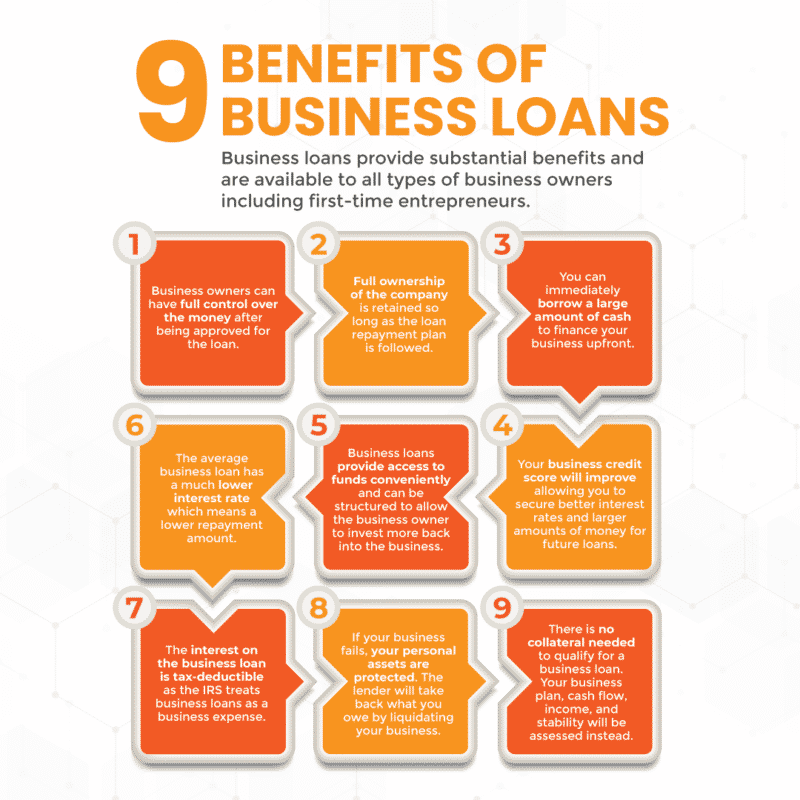

All you have to do is to stay within that credit line. Use your credit responsibly and also make prompt regular monthly payments, and you can make use of the credit history amount as lots of times as you like while developing a favorable credit report for your service. Company proprietors that do not have security or a strong enough credit report background to acquire term fundings can depend on organization bank card for quick funding.

Debt spiral danger: It is easy for balances and also passion to accumulate if you are not able to make your month-to-month payments promptly. If you miss out on one payment, the overdue equilibrium surrender to the following repayment period, and you will be charged interest on the new quantity, implying your following repayment will certainly be greater.

Rumored Buzz on Paypal Business Loan

This can quickly create an ever-increasing hole of debt and also it's very tough to climb out without a large infusion of cash money. Credit score restrictions: All organization bank card include limits, and also remaining within your limit can in some cases verify to be a trouble. You might navigate this by utilizing numerous cards, or you may be able to negotiate greater restrictions in time.Sadly, when it comes to bank card, you're at the grace of the debt provider. Can not use it for all kinds of payments: Tiny business proprietors that need quick moneying to make pay-roll or pay lease usually can't utilize bank card to make these certain sorts of settlements. Based on your individual credit report: Also most business credit rating cards are still connected to the organization owner's personal credit rating.

One advantage of a Seller Money Advancement is that it is reasonably easy to obtain. An additional benefit is that local business owner can get the cash within a couple of days. However, it is not appropriate for companies which have couple of credit card deals, due to the fact that they will not have sufficient deal volume to obtain approved.: In billing factoring, the lender purchases unpaid invoices from you and also offers you a lot of the invoice quantity upfront.

Invoice factoring allows you to receive the cash that you need for your service without awaiting your consumers to pay. The only issue with this kind of small company funding is that a majority of your company earnings need to originate from sluggish paying billings. You should additionally have strong credit scores history and a record of consistently-paying consumers.

Paypal Business Loan Can Be Fun For Everyone

Allow's take a thorough consider exactly how Fundbox operates in order to understand why it can be a great alternative for your business financing. Here are some things to recognize regarding Fundbox: Decision within hours: You can register online in seconds as well as get a credit choice in hrs. When you determine to sign up, all you need to do is connect your accounting software program or business savings account with Fundbox.

If you pay early, then the later fees can obtain removed. As a little organization proprietor, you know that there are a great deal of funding options available. We hope this overview helps you begin to pick which option makes one of the most sense for you. Think about the adhering to information regarding your business prior to making your following relocation: Personal credit history rating: Have a look at your individual credit report.

Paypal Business Loan - Truths

If your credit history is typical or low, then you will possibly need to pay greater rate of interest or you might be denied entirely. Business credit scores: See to it that your organization has a good credit report score, as the loan providers will certainly take your organization credit scores right into factor to consider prior to accepting it for a financing.visit homepage Organization profits: The lending alternatives will differ depending on the way your organization generates profits. It used to be that a major financial institution was one of your only options for getting access to an organization line of credit, but not anymore - PayPal Business Loan.

Report this wiki page